What is the Fed funds rate? The federal funds rate, or Fed rate, is the interest rate that U.S. banks pay one another to borrow or loan money overnight. It also affects interest rates on everyday consumer products, such as credit cards or mortgages.

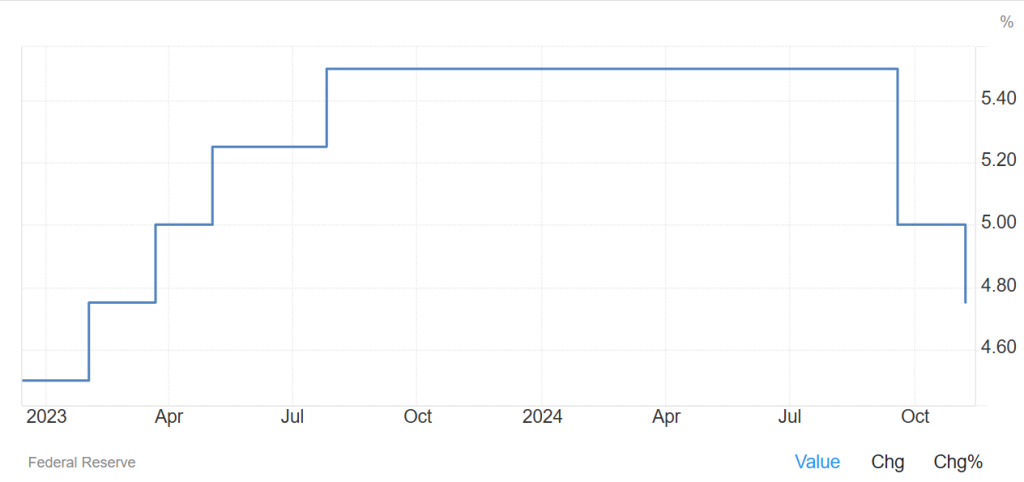

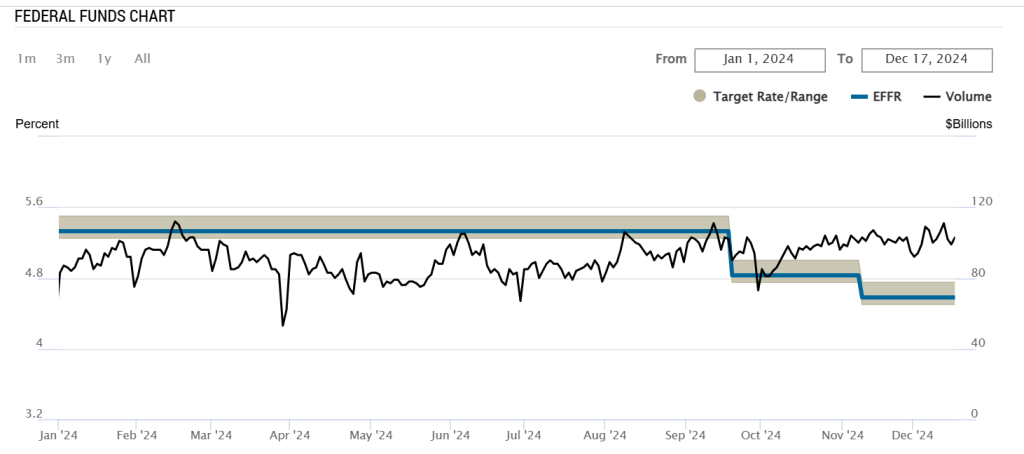

The Fed is widely expected to announce another 25bps cut to the federal funds rate at its December 2024 meeting, marking the third consecutive reduction this year and bringing borrowing costs to the 4.25%-4.5% range. Policymakers are also set to unveil fresh economic projections, with many investors anticipating a slower pace of rate cuts in 2025. Markets currently predict three additional reductions next year, and some expect a pause in January. The disinflation process is progressing more slowly than anticipated. The annual inflation rate in the US rose for the second consecutive month to 2.7%, consumer spending remains robust, and the labor market continues to demonstrate resilience, with employers adding 227K jobs in November, significantly surpassing forecasts. Given these dynamics, policymakers may revise their forecasts for 2024 to reflect higher inflation, lower unemployment, and stronger economic growth than previously anticipated.

Effective Federal Funds Rate NY Fed- https://www.newyorkfed.org/markets/reference-rates/effr

Effective Federal Funds Rate ST Louis – https://fred.stlouisfed.org/seriesBeta/FEDFUNDS

Fed Funds Data

| DATE | RATE (%) | 1ST PERCENTILE (%) | 25TH PERCENTILE (%) | 75TH PERCENTILE (%) | 99TH PERCENTILE (%) | VOLUME ($Billions) | TARGET RATE/RANGE (%) |

|---|---|---|---|---|---|---|---|

| 12/17 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 103 | 4.50 – 4.75 |

| 12/16 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 99 | 4.50 – 4.75 |

| 12/13 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 102 | 4.50 – 4.75 |

| 12/12 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 111 | 4.50 – 4.75 |

| 12/11 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 106 | 4.50 – 4.75 |

| 12/10 | 4.58 | 4.56 | 4.58 | 4.59 | 4.70 | 102 | 4.50 – 4.75 |

| 12/09 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 100 | 4.50 – 4.75 |

| 12/06 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 107 | 4.50 – 4.75 |

| 12/05 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 109 | 4.50 – 4.75 |

| 12/04 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 99 | 4.50 – 4.75 |

| 12/03 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 94 | 4.50 – 4.75 |

| 12/02 | 4.58 | 4.56 | 4.58 | 4.59 | 4.64 | 92 | 4.50 – 4.75 |

| 11/29 | 4.58 | 4.55 | 4.58 | 4.59 | 4.60 | 95 | 4.50 – 4.75 |

| 11/27 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 103 | 4.50 – 4.75 |

| 11/26 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 101 | 4.50 – 4.75 |

| 11/25 | 4.58 | 4.56 | 4.58 | 4.59 | 4.60 | 103 | 4.50 – 4.75 |

| 11/22 | 4.58 | 4.56 | 4.57 | 4.59 | 4.70 | 100 | 4.50 – 4.75 |

| 11/21 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 101 | 4.50 – 4.75 |

| 11/20 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 102 | 4.50 – 4.75 |

| 11/19 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 99 | 4.50 – 4.75 |

| 11/18 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 103 | 4.50 – 4.75 |

| 11/15 | 4.58 | 4.56 | 4.57 | 4.59 | 4.65 | 104 | 4.50 – 4.75 |

| 11/14 | 4.58 | 4.56 | 4.57 | 4.59 | 4.64 | 107 | 4.50 – 4.75 |

| 11/13 | 4.58 | 4.56 | 4.57 | 4.59 | 4.65 | 105 | 4.50 – 4.75 |

| 11/12 | 4.58 | 4.56 | 4.57 | 4.59 | 4.60 | 101 | 4.50 – 4.75 |