When Do Futures Trade?

Futures contracts trade on organized exchanges, and their trading hours are distinct from regular stock market hours. The trading hours for futures contracts can vary depending on the exchange and the specific contract being traded. Here are some general guidelines:

1. **Standard Trading Hours:**

- **Day Session:** The primary or standard trading session for most futures contracts typically occurs during regular market hours, roughly from 9:00 AM to 4:00 PM local time of the exchange where the contract is listed. This mirrors the regular trading hours of the stock market.

2. **Overnight Trading (Electronic Trading):**

- Many futures contracts also have electronic or overnight trading sessions. This allows for trading to occur outside of the standard market hours.

- The overnight trading session often starts shortly after the close of the regular trading session and can extend into the early morning hours of the next day.

3. **24-Hour Trading:**

- Some futures markets operate continuously, providing 24-hour trading opportunities. This is often the case for globally traded commodities like oil and currencies.

- Continuous trading allows market participants around the world to access the market at any time, leading to increased liquidity and the ability to react to international news and events.

4. **Exceptions and Variations:**

- While many futures contracts have extended trading hours, not all contracts trade around the clock. The trading hours can vary based on the specific contract and the exchange on which it is listed.

- Additionally, there may be periodic pauses in trading, such as maintenance periods or breaks between trading sessions.

5. **Holidays:**

- Futures markets may have different trading hours on holidays or may be closed entirely on certain holidays. Traders should be aware of any holiday schedules and market closures.

It's important for traders and investors to check the specific trading hours for the futures contracts they are interested in, as these can vary based on the commodity or financial instrument being traded and the exchange where the contract is listed. Information about trading hours is typically available on the respective exchange's website or through the trading platform provided by the broker.

Do futures trade on Sunday?

What are the trading hours for Equity Index futures? Sunday – Friday 5:00 p.m. – 4:00 p.m. Central Time (CT) with a trading halt from 4:00 p.m. – 5:00 p.m. CT.

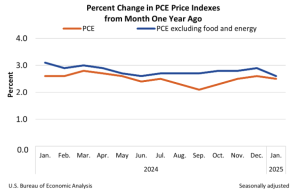

What is the Personal Consumption Expenditures Price Index

A measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

See: https://www.bea.gov/data/personal-consumption-expenditures-price-index

What is the Personal Consumption Expenditures Price Index, Excluding Food and Energy?

A measure of prices that people living in the United States, or those buying on their behalf, pay for goods and services. It's sometimes called the core PCE price index, because two categories that can have price swings – food and energy – are left out to make underlying inflation easier to see.

https://www.bea.gov/news/2024/personal-income-and-outlays-december-2023

What is Treasury Quarterly Refunding?

The Treasury Quarterly Refunding is a critical process undertaken by the U.S. Department of the Treasury to manage the national debt. It occurs four times a year, typically in the middle of each calendar quarter (February, May, August, and November). Here's a breakdown of its key aspects:

Purpose:

- To raise money for the government: The U.S. government constantly incurs expenses that exceed its current revenue. The Treasury Quarterly Refunding allows it to borrow money by issuing new Treasury securities (bonds, notes, and bills) to investors.

- Manage the maturity of existing debt: As existing Treasury securities mature, the Treasury issues new ones to replace them and avoid defaulting on its obligations.

- Influence interest rates and market liquidity: The Treasury can adjust the types and amounts of securities issued, which can affect interest rates and the availability of cash in the financial system.

Process:

- Gathering input: The Treasury solicits advice from the private sector, primarily through consultations with major investment banks known as "primary dealers." They also hold meetings with the Treasury Borrowing Advisory Committee (TBAC) and consider public feedback.

- Decision-making: Based on market conditions, economic forecasts, and the information gathered, the Treasury decides on the specific types and amounts of securities to be issued. This decision is usually announced through a "quarterly refunding statement" released shortly before the auctions.

- Auctions: The new securities are auctioned off to investors in competitive bidding processes. The Treasury awards the securities to the bidders who offer the highest prices and best terms for the government.

Outcomes:

- Funds raised: The auctions raise money for the Treasury to meet its financial obligations.

- Market impact: The Treasury's borrowing decisions can influence interest rates and market liquidity, which can have far-reaching economic consequences.

- Transparency: The Treasury publishes detailed information about the quarterly refunding process, including auction results, on its website.

Current Status (as of January 31, 2024):

- The details for the first quarter of 2024 refunding, initially estimated at $776 billion, were expected to be released today, Wednesday, January 31st, at 8:30 AM Eastern Time.

Resources:

- You can find more information about the Treasury Quarterly Refunding process on the Treasury Department's website: https://home.treasury.gov/policy-issues/financing-the-government/quarterly-refunding

- You can also access the latest details about the current refunding and past releases here: https://home.treasury.gov/policy-issues/financing-the-government/quarterly-refunding

What is a FOMC Announcement?

An FOMC announcement, or Federal Open Market Committee announcement, is a statement released by the Federal Reserve following its eight regularly scheduled meetings each year. These meetings are held to discuss and decide on the direction of monetary policy in the United States.

Here's a breakdown of what's typically included in an FOMC announcement:

- A summary of the Committee's discussion on economic and financial conditions. This includes an assessment of the current state of the economy, such as unemployment, inflation, and economic growth.

- The Committee's decision on the target federal funds rate. The federal funds rate is the interest rate that banks charge each other for overnight loans. It is the Fed's primary tool for influencing borrowing and lending activity in the economy.

- A statement about the Committee's plans for future monetary policy. This may include guidance on how the federal funds rate is likely to change in the coming months or years.

- The minutes of the Committee's meeting. These are released three weeks after the meeting and provide a more detailed account of the Committee's discussion and decision-making process.

Why are FOMC announcements important?

FOMC announcements are closely watched by financial markets and investors because they can have a significant impact on interest rates, stock prices, and the exchange rate. A change in the target federal funds rate can also ripple through the economy, affecting borrowing costs for businesses and consumers.

Here are some of the reasons why FOMC announcements are so important:

- They can signal changes in the Fed's stance on monetary policy. This can give investors and businesses a heads-up on what to expect in terms of interest rates and economic growth.

- They can affect asset prices. For example, a rate hike can put downward pressure on stock prices, while a rate cut can boost them.

- They can influence the exchange rate. A stronger dollar can make it more expensive for U.S. businesses to export goods, while a weaker dollar can make imports cheaper.

Here are some additional resources that you may find helpful:

- The Federal Reserve Board's website: https://www.federalreserve.gov/

- The Federal Open Market Committee: https://www.federalreserve.gov/newsevents/pressreleases/monetary20230222a.htm

- Investopedia's definition of the Federal Open Market Committee: https://www.investopedia.com/terms/f/fomc.asp

I hope this explanation is helpful! Let me know if you have any other questions.

2024 FOMC Meetings

January

30-31

March

19-20*

Apr/May

30-1

June

11-12*

July

30-31

September

17-18*

November

6-7

December

17-18*

Personal Consumption Expenditures (PCE)

What Is Personal Consumption Expenditures (PCE)?

Personal consumption expenditures (PCE), also known as consumer spending, is a measure of the spending on goods and services by people of the United States. According to the Bureau of Economic Analysis (BEA), a U.S. government agency, PCE accounts for about two-thirds of domestic spending and is a significant driver of gross domestic product (GDP).1

The BEA compiles an estimated total for PCE to measure and track changes in spending on consumer goods over time. This figure can provide an idea of economic strength and how price changes can affect spending.2

The BEA Personal Income and Outlays report releases monthly personal spending and income statistics. The report also includes the latest calculation for the Personal Consumption Expenditures Price Index (PCEPI), which measures price changes and provides a view of inflation.3

Key Takeaways

Personal consumption expenditures is a measure of consumer spending.

PCE is constructed and reported by the Bureau of Economic Analysis, along with personal income and the PCE Price Index in the Personal Income and Outlays report.

PCE includes how much is spent on durable and non-durable goods and services.

The PCEPI is the method used by the Federal Reserve to measure inflation.

The PCE figures can affect decisions about business offerings, hiring, and investments.

Understanding Personal Consumption Expenditures (PCE)

Consumer spending is an important factor that drives the U.S. economy and is a key part of GDP. That's why it is considered a leading economic indicator. PCE sheds light on buying habits and savings levels.

Economists and analysts use PCE to make projections about future spending and economic growth. It gives companies insight into their business needs concerning products and services and can affect hiring and investing. The BEA uses consumer spending to calculate its inflation gauge, the PCE Price Index, which is why measuring and tracking PCE is important.3

Personal consumption expenditures have been reported by the BEA since 2012 in both current dollars and chained dollars. PCE is one of the three parts of the BEA's monthly Personal Income and Outlays report:

Personal income shows how much money consumers earn

Disposable personal income represents income available after taxes are paid

Personal consumption expenditures are called outlays or consumer spending4

The PCE Price Index

In addition to reporting the three measurements above, the Personal Income and Outlays report includes the PCE Price Index (PCEPI) figures. The PCEPI measures the prices consumers pay for goods and services and changes in those prices. It is considered a gauge of inflation in the U.S. economy.

The PCE Price Index is calculated using PCE data. It may indicate whether prices are inflating or deflating and how consumer spending behavior changes in response.3

The PCEPI provides two figures:

One is derived from all spending categories for PCE

The second excludes data for food and energy and is known as the core PCE price index5

The core PCEPI can make an underlying inflation trend more visible. That's because food and energy prices can obscure it due to their more frequent volatility compared to other prices.

Tracking the PCE Price Index

The BEA uses the current dollar value of PCE to calculate the PCE Price Index. As mentioned, PCEPI shows price inflation or deflation that occurs from one period to the next. Like most price indexes, the PCEPI must incorporate a deflator (the PCE deflator) and real values to determine the amount of periodic price change.4

Both the PCE Price Index and the Core PCE Price Index (which, again, excludes prices for food and energy) show how much prices change from one period to another. Breakdowns of the PCEPI show price inflation/deflation by category as well.6

Fed Preference for the PCE Price Index

In 2012, the PCE Price Index became the primary inflation index used by the Federal Reserve when making monetary policy decisions. The Fed prefers the PCEPI over the comparable Consumer Price Index (CPI) because:

The PCEPI better reflects changes to consumer spending, such as selecting substitute goods due to price changes

It covers a broader range of spending

Past information can be adjusted to support recent information7

The PCEPI is also weighted by data acquired through business surveys, which tend to be more reliable than the consumer surveys used by the CPI. PCEPI also uses a formula that allows for changes in consumer behavior and changes that occur in the short term.8

These factors result in a more comprehensive measure of inflation. The Fed depends on the nuances that the PCEPI reveals because even minimal inflation can be considered an indicator of a growing economy.

Other measures of inflation tracked by economists include the Producer Price Index (PPI) and the Gross Domestic Product Price Index.

Personal consumption expenditures and the PCE Price Index are two different measurements. PCE measures consumer spending on goods and services, while the PCEPI measures the prices of those goods and services. The Bureau of Economic Analysis calculates the figures for both.31

How PCE Is Measured

The BEA reports the total value of personal consumption expenditures collectively every month. Like most economic breakdowns, PCE is split between consumer goods and services. Durable goods and nondurable goods are components of the consumer goods figure.

Durable goods are items that last longer than three years. Examples include cars, electronics, appliances, and furniture. Nondurable goods have a life expectancy of under three years. These include products like cosmetics, gasoline, and clothing. Services are tasks performed for the benefit of the recipient. Examples of services are legal advice, house cleaning, and plumbing.

Specifically, the categories represented in PCE data include the following:

Durable goods: Motor vehicles and parts, furnishings and durable household equipment, recreational goods and vehicles, and other durable goods

Nondurable goods: Food and beverages purchased for off-premises consumption, clothing and footwear, gasoline and other energy goods, and other nondurable goods

Services: Housing and utilities, healthcare, transportation services, recreation services, food services and accommodations, financial services and insurance, and other services9

BEA measures consumer spending for the nation and is broken down by state and the District of Columbia. While it issues the aforementioned monthly report, additional details are provided annually.2

According to the BEA, most PCE (valued by market prices, including sales tax) comes from household purchases of new goods and services from private businesses. It also includes household purchases of new goods and services from the government.

PCE also consists of spending by nonprofit institutions to provide services to households, household purchases of used goods, and the purchases of goods and services by U.S. residents in foreign countries.

PCE also includes spending on behalf of households by third parties, such as employer-paid health insurance and medical care financed through government programs, life insurance expenses, and pension plan expenses.10

Advantages and Disadvantages of PCE

Advantages

Personal consumption expenditures data provide a view of how the economy is faring. This information is important for economic policy purposes and business decision-making.

When people spend without hesitation, it usually means that the economy is doing well. When they cut back on spending, it points to problems in the overall economic picture.

PCE estimates aggregate spending for a large number of commodities. This can provide a view of spending that accounts for more goods and services actually purchased.

Disadvantages

PCE data may reflect measurement errors that occur during collection and in source data provided to the BEA. It may also reflect classification errors (after collection) in the personal sector and other sectors comprising the national accounts (PCE is part of the National Income and Product Accounts constructed by the BEA).

Prior PCE figures are subject to revision every year. That can result in different measurements over extended periods. Some observers feel that this reflects the inability to value personal consumption expenditures accurately.

Pros

Provides a view of the economy

Reports aggregate spending on a broad range of goods and services

Spending changes can indicate a growing economy or economic difficulties

Cons

May reflect data collection errors

May reflect data classification errors after collection

Figures are estimates and can be revised

Recent PCE Readings

Personal income was roughly $23.95 trillion in June 2024. This represents an increase of 0.2% from the previous month. Disposable personal income remained fairly flat from the previous month at just under $17 trillion. PCE grew 0.3% to just over $19.44 trillion. The PCE Price Index increased by 0.1% from the previous month.4

What Is the Importance of the Personal Consumption Expenditures Number?

The personal consumption expenditures number shows how Americans collectively spend their money. Tracked from month to month, it is an indicator of the economy's health overall. It also is a key component of the PCE Price Index, which tracks inflation or deflation in consumer prices over time.

What Is the Difference Between the PCE Price Index and the Consumer Price Index?

The CPI is compiled monthly by the Bureau of Labor Statistics based on a survey of urban households. It measures the price of a basket of household goods and services that most people buy regularly. The PCE, produced monthly by the Bureau of Economic Analysis, also records changes in the prices of a basket of goods from month to month.111

What Does the PCE Data Show Us?

The PCE data for June 2024 showed an increase in personal consumption expenditures to just over $19.44 trillion from May 2024. This represents an increase of 0.3% from the previous month. The PCE Price Index increased by 0.1% from the previous month.4

The Bottom Line

Personal consumption expenditures, or PCE, allows economists, consumers, and businesses to see how well the economy is faring from month to month.

It measures how consumers spend their money and whether they save rather than spend. It also shows how people change their buying habits when prices change. This provides a window into demand for products and services which can help governments and businesses make decisions.

Trade Date vs Settlement Date

There are two key dates involved in a stock purchase transaction. The first is the trade date, which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is executed between the buyer and seller. This is the date when you officially own the stock. The time frame between the trade date and settlement date differs from one security to another, due to varying settlement rules attached to different types of investments.

Trade Dates and Settlement Dates for Stocks

As noted above, transactions are initiated on the trade date and are finalized on the settlement date. The market uses special terms to denote these dates—T+1, T+2, T+3, and so on. These abbreviations represent the transaction date (T) and the settlement period. For instance, T+1 means there is a one business day lag between the transaction and settlement date while T+2 means a trade settles two business days after the transaction is initiated.

As of May 28, 2024, stock transactions settle on a T+1 basis.1 This means settlement takes place a day after the trade is initiated. So if you buy a stock on Tuesday, the trade settles on Wednesday. Weekends and holidays may affect the settlement date for stock transactions. In these cases, settlement takes place on the next business day. This means that you own the stock on the settlement date.

rade Dates and Settlement Dates for Other Securities

Settlement dates vary by asset type. Consider the following timetables:

The settlement date is the same day as the trade or transaction date for bank certificates of deposit (CDs) and commercial paper.4

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date.1

Financial Industry Regulatory Authority. "Understanding Settlement Cycles: What Doest T+1 Mean for You?"

Foreign exchange spot transactions (other than USD/CAD transactions) settle date two days after the trade date. This is commonly referred to as T+2.5

When Are Mutual Fund Orders Executed?

Whether you are buying or selling shares in a mutual fund, most mutual funds execute trades once per day at 4 p.m. ET after the close of the market. Orders are typically posted by 6 p.m.12 Trade orders can be entered through a broker, a brokerage, an advisor, or directly through the mutual fund. Unlike other instruments like stocks and exchange-traded funds (ETFs), they are executed by the fund company rather than traded on the secondary market.

Mutual Fund Trading and Settlement

Mutual fund shares are highly liquid. They can be bought or sold (redeemed) on any day when the markets are open. Whether working through a representative, such as an advisor, or directly through the fund company, an order can be placed to buy or redeem shares, and it will be executed at the next available net asset value (NAV), which is calculated after market close each trading day.

Some brokerages and fund companies require orders to be placed earlier than the market close, while others allow same-day execution right up to the market close.

The settlement period for mutual-fund transactions varies from one to three days, depending on the type of fund.

What is Medicare Part A and B?

In general, Medicare Part A helps pay for inpatient care you get in hospitals, critical access hospitals, and skilled nursing facilities. It also helps cover hospice care and some home health care.

Medicare Part B (Medical Insurance) helps cover 2 types of services:

Medically necessary services: Services or supplies that meet accepted standards of medical practice to diagnose or treat your medical condition.

Preventive services: Health care to prevent illness (like the flu) or detect it at an early stage when treatment is likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts assignment

.

If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But your plan must give you at least the same coverage as Original Medicare.

Part B covers things like:

Ambulance services

Clinical research

Durable medical equipment (DME)

Limited outpatient prescription drugs

Mental health & substance use disorders

Oxygen equipment & accessories

Options trading volume ratio

In the context of options trading, a "volume ratio" refers to the ratio of put option volume to call option volume, used as a sentiment indicator to gauge whether investors are predominantly buying puts (bearish) or calls (bullish).

-

What it is:The put/call ratio (PCR) is calculated by dividing the total volume of put options traded by the total volume of call options traded within a specific timeframe, typically a trading day.

-

How it works:

- High PCR (above 1): Indicates that more put options are being traded than call options, suggesting a more bearish sentiment, or that investors are hedging against potential downside risk.

- Low PCR (below 1): Indicates that more call options are being traded than put options, suggesting a more bullish sentiment, or that investors are speculating on potential price increases.

- High PCR (above 1): Indicates that more put options are being traded than call options, suggesting a more bearish sentiment, or that investors are hedging against potential downside risk.

-

Contrarian Interpretation:The PCR can also be used as a contrarian indicator, where high ratios might suggest a market bottom and potential upward movement, while low ratios might indicate a market top and possible downward corrections.

-

Other Volume Ratios:Besides the put/call ratio, there are other volume ratios used in options trading, such as the option to stock volume ratio (O/S), which compares the total option trading volume to the total stock trading volume.

Put/Call Ratio

The put-call ratio (PCR) is an indicator used by investors to gauge the outlook of the market. The PCR is calculated as put volume over a determined time period divided by call volume over the same time period. The ratio is interpreted differently depending on the type of investor.

The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options.

A ratio of 0.7 is considered mostly neutral, while a low ratio (below 0.5) indicates an extremely bullish market sentiment, and a reading over 1.0 indicates an extremely bearish sentiment, for example.2